Part 1: Early market engagement – why “post it and hope” isn’t a sourcing strategy

Key issues in supply chain to be addressed in 2026 (4-part series)

Early market engagement is where procurement shifts from “post-it and hope” to proactive supplier engagement.

Let me start with something we see all the time.

A major project goes live. A shiny project page is created. Suppliers are told to “register their interest.” And then… everyone waits.

Procurement teams wait for enough suppliers to respond.

Suppliers wait to hear if anything will actually come of it.

Delivery teams wait while timelines quietly start to slip.

This is what I call the “hope and wait” model, and despite how common it is, it’s one of the biggest blockers to building resilient and agile supply chains.

Early market engagement is not “post-it and hope”

Posting an opportunity and waiting for suppliers to find it is not engagement. It’s passive. And passive systems fail under pressure.

From the supplier side, it’s exhausting. Many SMEs are registered on dozens of platforms, constantly re-entering the same information, monitoring portals, and responding to opportunities that may never go anywhere. That’s time they’re not spending delivering work or building capability.

From the buyer’s side, the problem just looks different. Registrations trickle in unpredictably. You don’t know if you’ve reached the right suppliers or just the most available ones. And when responses finally close, you’re often left wondering whether you’ve really seen the best the market has to offer.

The uncomfortable truth is this: every project resets the supply chain.

The page closes. The data disappears. The learning is lost.

And next time, everyone starts again from zero.

That’s not resilience. That’s repetition.

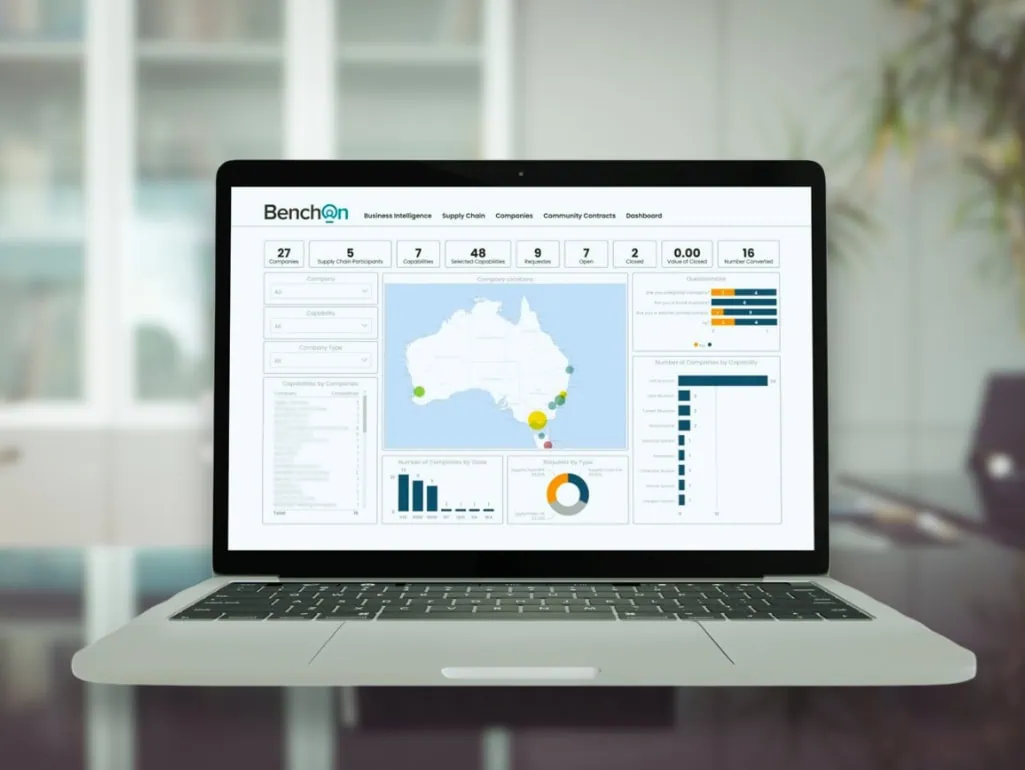

At BenchOn, we believe supply chains shouldn’t be rebuilt project by project. They should accumulate value over time.

Suppliers create a profile once, capturing their real capabilities, products, services, and skills. Buyers don’t wait and hope the right supplier sees a post. They actively match requirements to capability and engage suppliers directly, shifting from guesswork to capability-based sourcing.

If we want agility, we can’t rely on hope. We need systems designed to engage the market, and not just post to it.

If you want to sanity-check your current approach and reduce “hope and wait” risk on the next project, get in touch.

FAQs

How early should early market engagement start for major projects?

Early market engagement should start when the scope is still flexible, before requirements are locked and timelines are committed. If you wait until the project page is live, you have already limited the pool to whoever is monitoring portals that week.

How do buyers engage the market early without creating probity or fairness issues?

Use a consistent engagement method, document the criteria for outreach, and keep the door open to adding new suppliers based on capability, not relationships. Early engagement holds up best when it follows a repeatable pre-market engagement process and a clear market engagement plan. For government buyers, make sure your approach aligns with the Commonwealth Procurement Rules.

What should a buyer include in an early engagement to enable suppliers to respond meaningfully?

Suppliers respond better when buyers share practical details, even at a draft level, such as intended package structure, timing windows, compliance expectations, delivery locations, and the capability signals that will matter in shortlisting. This is also where a structured market-sounding process helps, as it makes feedback easier to compare across suppliers.

How can SMEs make themselves easier to match before a project goes live?

SMEs should maintain a supplier capability profile that is specific, current, and searchable, with clear offerings, service areas, constraints, and proof points. The goal is to reduce guesswork so they are discoverable even when a buyer is not on a single tender page and when buyer-supplier matching is happening behind the scenes.

What are the warning signs that your current sourcing model is “post-it and hope”?

Common signs include low-quality registrations, last-minute supplier scrambling, repeated outreach to the same suppliers, and an inability to explain whether the market was actually tested or whether it was just whoever happened to respond.

What should be measured to prove that early market engagement is improving outcomes?

Track time-to-shortlist, shortlist diversity, supplier response quality, supplier drop-off rates, and whether supplier capability data and learnings carry forward to the next project instead of disappearing when the page closes.

How do you engage suppliers early without overwhelming them with admin?

Ask for targeted information once, then reuse it. Early engagement fails when it becomes another portal form. It succeeds when supplier information is captured once and used many times through a consistent supplier discovery process and a disciplined supplier shortlisting process.